Indian share markets continue to trade on a flat note in the noon session. Gains are largely seen in metal stocks and realty stocks. Meanwhile, bank stocks and energy stocks are witnessing majority of the selling activity.

The BSE Sensex is trading higher by 5 points and the NSE Nifty is trading higher by 9 points. Meanwhile, the BSE Mid Cap index is trading up by 0.2% & the BSE Small Cap index is up by 0.6%. The rupee is trading at 64.16 to the US$.

The Sensex and the Nifty trading at a PE of 25 and 26.9 times respectively. The midcap and smallcap indices are trading at insane valuations at PEs of around 46.4 and 113.8 times. Mid and small caps have never seen such crazy valuations.

There is still another ratio, which is frequently used to evaluate the valuations. The market capitalization to GDP ratio. It is one of Buffett's favourite indicators of broader market value. The market cap of all the listed companies in the country divided by the gross domestic product (GDP) of the country gives us this ratio.

Market Cap to GDP Ratio Close to 100%

The idea behind this ratio is simple. Stock prices are derived from expected earnings for corporates and GDP represents revenue of the country. This gives investors an estimate of whether the two are moving in tandem. A ratio above 100% shows overvaluation and one below 50% shows that the market may be undervalued.

Even this ratio is showing valuations reaching its peak levels. India's market cap to GDP ratio reached 95%. This ratio was more than 100% after the 2007 bull run. Stock prices had seen a significant meltdown after that amid the global financial crisis. 2018 will, therefore, be critical for Indian companies to justify their valuations with earnings growth.

Axis Bank share price is presently trading down by 1.2% on the BSE after it was reported that market regulator has directed Axis Bank to conduct an internal inquiry to ascertain how key financial information was leaked on a WhatsApp group before it was officially announced on the stock exchange platform.

In its first order in the WhatsApp leak case, market regulator had last night ordered Axis Bank to strengthen its systems and conduct an internal probe to fix responsibility as the initial investigation showed that the leakage was due to "inadequacy" of processes at the bank.

In news from realty sector, DLF share price surged 2.1% on the BSE after it was reported in The Livemint that the company approved an issue of debentures and warrants to promoters in lieu of Rs 112.5 billion equity infusion into the company to reduce company's net debt significantly.

The company plans to sell shares through public issue or private placement to institutional investors. The company is looking to raise more than Rs 35 billion through this process.

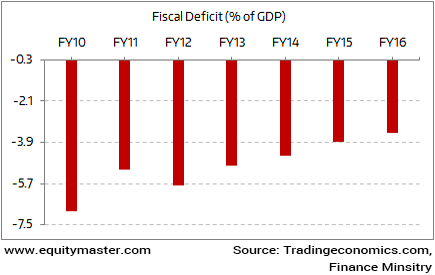

Moving on to news from the economy. A day after the Goods and Services Tax (GST) collection for November showed a decline in revenue receipts, the government has decided to raise additional market borrowing of Rs 500 billion through dated government securities in the last three months of FY18.

The move may result in a breach of its fiscal deficit target of 3.2% of gross domestic product (GDP) set for this fiscal year.

Besides, the government will trim down the T-Bills from present collections of Rs 862.03 billion to Rs 250.06 billion by March end 2018.

Since the revenue collection from the GST is slightly lower than the expected in the last two months, the additional borrowing would help bridge the shortfall. The GST collections fell for the second consecutive month to Rs 808.08 billion in November, down from Rs 833.46 billion in October, mainly due to sharp cuts in the tax on over 200 items from November 15.

This article was originally published in English at www.equitymaster.com

Read the complete Indian stock market update. For the terms of use, go here.